Ytd federal withholding calculator

Federal taxes were withheld as if I worked 80 hours in one week almost 40. Earnings Withholding Calculator.

Pin On Budget Templates Savings Trackers

Now the question is why doesnt TurboTax allow you to enter modify federal income tax withheld on.

. Urgent energy conservation needed. Free Federal and Illinois Paycheck Withholding Calculator. Free Federal and New York Paycheck Withholding Calculator.

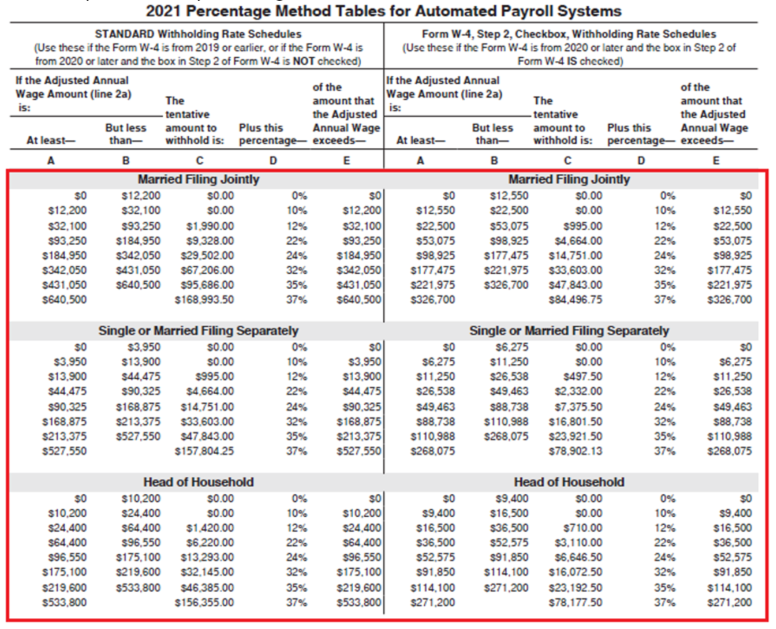

Raise your AC to 78 from 4pm - 9pm. IRS tax withholding calculator question. 10 12 22 24 32 35 and 37.

Free Federal and New York Paycheck Withholding Calculator. YTD federal income tax withholding can be entered in the W2 box. Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set.

Federal Income Tax Withheld NA. 2020 brought major changes to federal withholding calculations and Form W-4. See the IRS FAQ on Form W-4 to answer your questions about the changes.

Use the IRS Withholding Estimator to estimate your income tax and compare it with your current withholding. Free Federal and New York Paycheck Withholding Calculator. 2022 W-4 Help for Sections 2 3 and 4.

ESmart Paychecks free payroll calculator is a paycheck calculator that can be used to calculate and print paychecks and paystubs. Exemption from Withholding. Paycheck Managers Free Payroll Calculator offers online payroll tax deduction calculation federal income tax withheld pay stubs and more.

1547 would also be your average tax. Prior YTD CP. A pay stub should also list deductions for both this pay period and the YTD.

2022 Federal New York and Local. The tax calculator asks how much federal taxes am I paying ytd. 10 12 22 24 32 35 and 37.

Federal taxes were withheld as if I worked 80 hours in one week almost 40. The Tax Withholding Estimator compares that estimate to your current tax withholding and can help you decide if you need to change your withholding with your. Youll need your most recent pay stubs and income tax return.

This online calculator is excellent for pre-qualifying for a mortgage. 2022 W-4 Help for Sections 2 3 and 4. Until they decide to change the math formula to look at.

Calculate your state local and federal taxes with our free payroll income tax calculator simply choose your state and you are all set. Turn off unnecessary lights appliances - Learn more at. 2022 Federal New York and Local Payroll Withholding.

Switch to Arkansas hourly calculator. The tax calculator asks how much federal taxes am I paying ytd. 2020 brought major changes to federal withholding calculations and Form W-4.

YTD federal income tax withholding can be entered in the W2 box.

How To Calculate Federal Income Tax 11 Steps With Pictures

Paycheck Tax Withholding Calculator For W 4 Tax Planning

Federal Updates

29 Free Payroll Templates Payroll Template Payroll Checks Invoice Template

Calculation Of Federal Employment Taxes Payroll Services

Calculation Of Federal Employment Taxes Payroll Services

Calculating Federal Income Tax Withholding Youtube

How To Calculate Federal Income Tax 11 Steps With Pictures

Paycheck Calculator Online For Per Pay Period Create W 4

Calculate Civilian Equivalent Pay For Single 6 Year O 3 W No Dependents Finance Paycheck Paying

Is There A Wage Minimum Limit Before Federal Tax Is Withheld My W 2 Shows No Federal Tax Withheld On My Line 1 Wages Of 4657 89

How To Calculate Travel Nursing Net Pay Bluepipes Blog Travel Nursing Travel Nursing Pay Nurse

Payroll Tax Prep Tax Preparation Payroll

Excel Formula Income Tax Bracket Calculation Exceljet

Withholding Taxes How To Calculate Payroll Withholding Tax Using The Percentage Method Youtube

Pay Stub Examples And Importance Is Our Article Which Is Meant To Provide Basic Details About Pay Stub Formats Payroll Template Good Essay Resume Template Free

How To Calculate Payroll Taxes Methods Examples More